U.S. Debt Ceiling Crisis: Lesson for India?

Abstract

The U.S. is on the verge of an unprecedented default as the White House and Congress disagree over increasing the debt ceiling, which was breached in January 2023. This article explains the debt ceiling crisis and its potential implications for India. It demonstrates that a U.S. default could impact India’s financial markets and foreign trade and destabilise the economy. This is because the U.S. Dollar (USD) is the world’s reserve currency, and U.S. Treasury Bonds are a part of India’s foreign debt. This article also suggests that India’s way forward is to move away from a U.S.-driven international financial system to a multi-currency international system through the example of the Special Vostro Rupee Accounts (SVRAs).

Keywords: Debt Ceiling, U.S., Foreign Trade, Financial Markets, Reserve Currency, Special Vostro Rupee Account

Introduction

The world waits in anticipation as proposals to raise the U.S. debt ceiling have been put on hold after Janet Yellen, the Secretary of the U.S. Treasury, warned that the country could default on its debts. The possibility of the U.S. defaulting could collapse the global economy because it relies on the consistency and dependability of the U.S. financial instruments. This paper attempts to understand the debt ceiling and trace the timeline of the current debt ceiling crisis, its implications, and the way forward for India.

What is the debt ceiling crisis?

The debt ceiling refers to the amount of money the U.S. government can borrow to pay for its services. Every year, the U.S. government receives revenue and incurs expenditures greater than the revenue, leading to a deficit. Over the past decade, this deficit has ranged from $400 billion to $3 trillion, and the leftover deficit at the end of the year gets added to the existing debt (Aratani, 2023b).

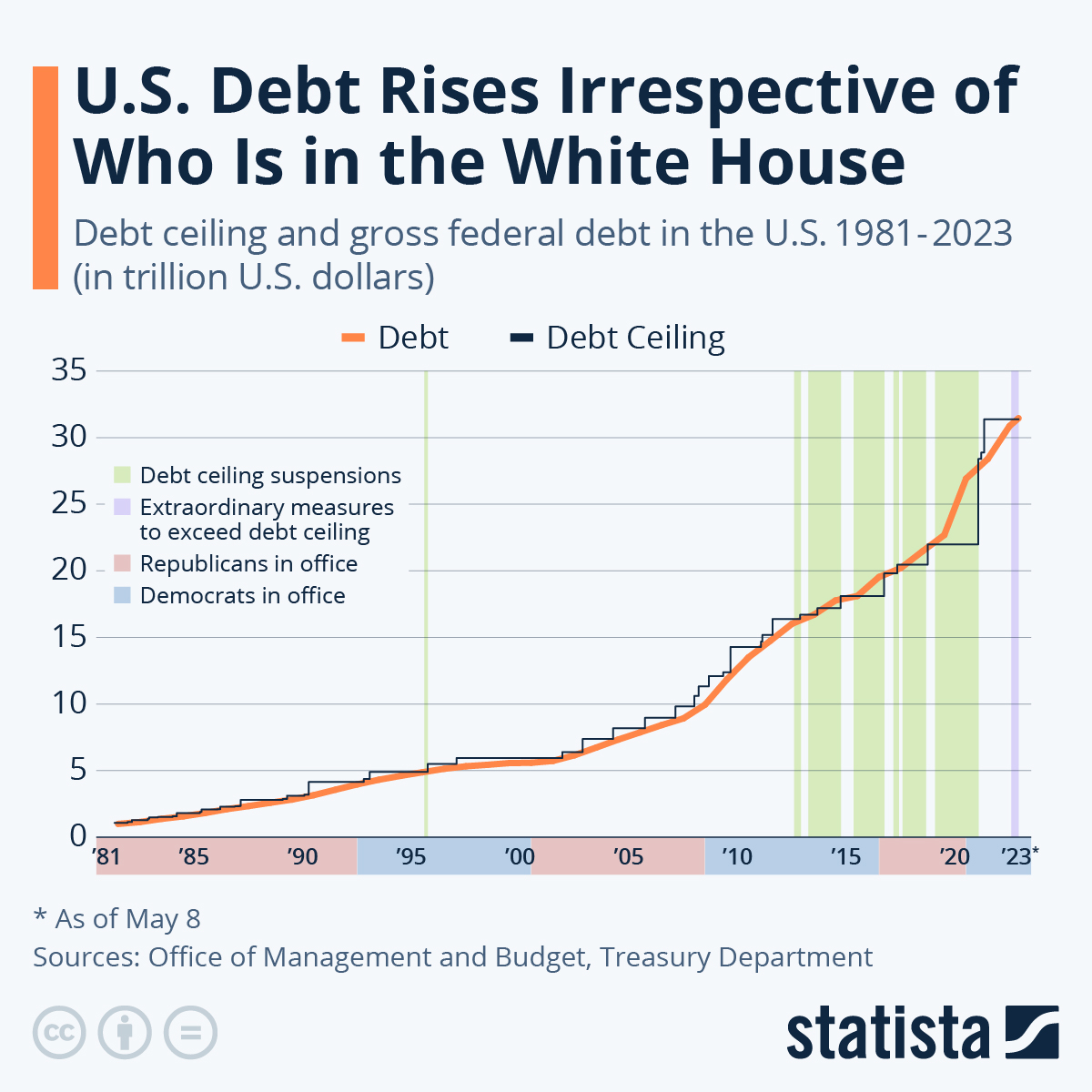

To finance the debt, the U.S. Treasury issues securities like the U.S. government bonds that it repays with interest. However, the Treasury can issue securities only till the debt ceiling. Once this is breached, the U.S. Treasury adopts ‘extraordinary measures’ to continue making payments. However, the Treasury can make these payments only until the so-called ‘X-date’ when all the cash will run out. The ‘X-date’ depends on the inflows and outflows of the U.S., and Congress must raise the debt ceiling before the ‘X-date’ to prevent a default (Edelberg & Sheiner, 2023). Since 1960, the debt ceiling has been increased 78 times- 49 times under Republican administrations and 29 times under Democratic administrations (Aratani, 2023b). The last time the U.S. came close to default was in 2011 when President Obama and Congress were at loggerheads over spending cuts. Republican demands were accepted, and the debt ceiling was raised three days before the deadline for default (Aratani, 2023a).

History of the U.S. debt ceiling The U.S. debt ceiling has a long history, introduced in 1917 as a mechanism to control the government’s borrowing. Initially set to ensure fiscal responsibility during World War I, the debt ceiling has since become a recurring feature of U.S. economic policy. Over the years, Congress has used the debt ceiling as a tool for negotiating broader fiscal policies, often leading to periods of political deadlock. The U.S. has raised the debt ceiling multiple times to accommodate rising expenditures, but each time, the debate around it highlights the fragility of the U.S. financial system’s reliance on Congressional approval. For instance, the 2011 debt ceiling crisis led to significant market disruption, and its effects were felt globally. |

Debt ceiling during the Obama and Trump administrations

The debt ceiling has been a recurring point of contention in U.S. politics, particularly during the Obama and Trump administrations, each facing its own challenges in managing the nation’s borrowing limit.

Obama Administration (2009-2017) The most notable debt ceiling crisis during Barack Obama’s presidency occurred in 2011. At the time, the U.S. was emerging from the global financial crisis, and the government needed to borrow more to fund recovery efforts. However, negotiations between President Obama and the Republican-controlled House of Representatives stalled over demands for significant spending cuts in exchange for raising the debt ceiling. The impasse led to a prolonged standoff, which brought the U.S. to the brink of default. It wasn’t until three days before the deadline that Congress passed the Budget Control Act of 2011, which increased the debt ceiling by $2.1 trillion while implementing future spending cuts. The near-default shook financial markets globally, with the Dow Jones Industrial Average dropping nearly 20%, and resulted in Standard & Poor’s downgrading the U.S. credit rating for the first time in history. This episode highlighted the risks of political brinkmanship surrounding the debt ceiling and the broader implications for global financial stability. It also highlighted the fragility of the U.S. economy’s recovery, which could have been severely impacted by a default. | Trump Administration (2017-2021) Under President Donald Trump, the approach to the debt ceiling was less contentious compared to the Obama years. During Trump’s presidency, the debt ceiling was raised multiple times without the severe standoffs that characterised previous administrations. In 2017, after some negotiation, Trump signed into law a bill that suspended the debt ceiling until March 2019, allowing the government to continue borrowing without a formal increase in the limit. The administration’s tax cuts and increased military spending contributed to significant growth in the federal deficit, leading to a larger debt load. In 2019, Trump again signed a bipartisan budget deal that suspended the debt ceiling until July 2021. Despite these increases, the Trump administration avoided a major debt ceiling crisis largely due to a Republican-controlled Congress during much of his term, which aligned with the administration’s fiscal policies. However, the rapid accumulation of debt set the stage for the current debt ceiling debate, as the U.S. debt grew substantially under Trump’s tenure, particularly following the economic response to the COVID-19 pandemic. |

Comparison and lessons for today

While Obama’s administration faced a high-stakes negotiation that resulted in market instability and a credit downgrade, Trump’s presidency saw a more cooperative, albeit fiscally expansive, approach to raising the debt ceiling. Both experiences provide lessons for future U.S. administrations: the importance of bipartisan cooperation and the risks associated with allowing political disputes to escalate to the point of threatening global financial stability.

For public policy aspirants, these historical examples highlight the delicate balance between fiscal responsibility, political negotiation, and economic stability. They also offer valuable insights into how debt management strategies can shape the economic future of a nation, and why it’s critical to develop policy frameworks that prevent the debt ceiling from becoming a recurring source of political and economic risk.

2023 debt ceiling crisis: Timeline

On January 19, 2023, the U.S. reached its debt ceiling of $31.4 trillion. Since then, the U.S. Department of Treasury has adopted ‘extraordinary measures’ to keep the debt from binding. On April 26, the Republicans passed a bill in the House of Representatives raising the debt ceiling by $1.5 trillion conditional to a $4.8 trillion in spending cuts over ten years. However, the Democrats have refused to discuss spending cuts (Aratani, 2023b).

In a letter to Kevin McCarthy, Speaker of the House of Representatives, Janet Yellen said that the Treasury would “be unable to continue to satisfy all of the government’s obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time” (Yellen, 2023). The June 1 deadline is crucial for the U.S. economy because the U.S. could witness a catastrophically historic sovereign default if the White House and Congress fail to reach a consensus on increasing the debt ceiling by then (Aratani, 2023b).

Lessons from global reactions to U.S. debt crises The U.S. debt ceiling crisis has had significant global consequences in the past, and 2023 is no exception. Markets across the world tend to react negatively to uncertainty regarding U.S. debt payments. In 2011, the last time the U.S. approached default, global stock markets experienced a dramatic drop of around 20%. Countries heavily dependent on the U.S. dollar, like India, felt the impact in the form of increased market volatility and reduced investor confidence. The financial ripples from U.S. economic instability extend across borders, affecting international trade, investments, and monetary policies. For India, it highlights the vulnerability of depending on the stability of a single country’s financial decisions. |

Consequences of defaulting for India

There is uncertainty regarding the potential consequences for India if a U.S. default occurs, given its unprecedented nature. However, in a letter to Kevin McCarthy, Janet Yellen mentioned that the inability to repay the debt would spell “irreplaceable harm to the U.S. economy, the livelihoods of all Americans and global financial stability” (Aratani, 2023b). Some of the possible consequences of a potential U.S. default on India are the following:

1. Financial Market Volatility

Experts believe that the shock of default would impact the financial markets — stocks, bonds, mutual funds, and derivatives — before spilling into the broader economy. Stocks could plummet, expecting a broader economic downturn. Investors could withdraw money from the market when interest rates rise to maintain access to short-term funding. The banking industry might become more cautious about making new loans. (Stein, 2023). The bond markets would tremble when existing Treasury bonds prices decline due to increased yields on new ones, particularly ones closer to the X-date (The White House, 2023). Moreover, the credibility of the U.S. Treasury might suffer from a downgrade in the country’s credit ratings, making investing in the U.S. less appealing (Snell, 2023).

Moody’s Analytics has estimated that stock prices may fall by roughly 20%, while the White House estimated a 45% decline. Businesses would likely halt expansion — driving stocks down even more. In 2011, the last time the U.S. came close to default, major stock indices fell by around 20% (Stein, 2023).

However, Anuj Gupta, Vice President of Research at IIFL Securities, is optimistic that Foreign Institutional Investors (FIIs) buying in the Indian stock market will unlikely be affected in the short run. According to him, the chances of a U.S. default are minimal, and the market is bracing itself for either acceptance of the debt ceiling or printing new currency (Manohar, 2023). However, the Indian stock market will see some level of correction.

Impact on India’s forex reserves One of the significant ways a U.S. default could affect India is through its foreign exchange reserves. India holds a substantial amount of U.S. Treasury bonds as part of its forex reserves, which are vital for maintaining currency stability and supporting international trade. In the event of a U.S. default, the value of these bonds would drop significantly, impacting India’s reserves. Such a scenario could lead to increased volatility in the Indian rupee, causing fluctuations in currency exchange rates. A decline in the value of U.S. bonds could also force India to re-evaluate its investment strategy, seeking alternative reserves that are less tied to the U.S. economy. |

2. Impact on Foreign Trade Due to a Weakening Dollar

The demand and value of U.S. dollars depend on the creditworthiness of the U.S. Treasury assets. Any decrease in investor confidence in the American economy could lead them to sell US Treasury bonds, devaluing the dollar. (Berman, 2023). The fear of not being paid back on time due to default would make holding U.S. Treasury securities less desirable, decreasing the demand for dollars globally. Investors might reduce their dollar holdings due to weakening government dollar purchases. This would raise volatility in the dollar’s value relative to other currencies and decrease liquidity (Lovely & Russ, 2023).

The International Monetary Fund (IMF) suggests that a dollar depreciation affects commodity prices in the world market by encouraging the demand for items priced in dollars, making commodities a more attractive investment option for foreign investors compared to dollar-denominated assets, and stimulating a monetary policy that encourages foreign demand for commodities (Elwell, 2012). Should the dollar depreciate, the rupee is likely to appreciate in response. This could lead to an increase in imports and a decrease in exports, worsening the trade balance while possibly reducing inflationary pressure (Fan, 2002).

Impact on India’s imports and exports The weakening of the U.S. dollar could have both positive and negative consequences for India’s trade sector. On the positive side, a depreciating dollar would make imports cheaper, particularly in energy sectors like oil, where India is a significant importer. Lower energy costs could reduce inflationary pressures and improve the trade balance. However, a stronger rupee, driven by a weaker dollar, could harm India’s export competitiveness. Key sectors such as IT services, pharmaceuticals, and textiles, which rely on exporting goods and services to the U.S., could see reduced revenues. These industries often operate on thin margins, and a stronger rupee would make Indian goods more expensive for foreign buyers, potentially shrinking demand. Thus, while India might benefit from cheaper imports, its export industries could suffer significant setbacks. |

3. Economic Problems with U.S. Bonds and USD as Reserve Currency

U.S. government bonds are crucial for the global financial system because of their safety. U.S. Treasury Bonds serve as reserves for everything from foreign nations’ central banks to money market funds. Any financial instrument whose value relies on Treasury bonds could experience volatility and uncertainty after a debt ceiling breach due to a rapid price reduction. Breaching the debt ceiling could drive the U.S. bonds’ value down, hurting the foreign exchange reserves of many nations (Stein, 2023).

As the world reserve currency, the USD provides the U.S. with tremendous economic benefits. It stabilises the demand for dollars and reduces the forex risk U.S. companies face in international transactions. Moreover, the U.S. faces lower debt-service costs or default risk and lower costs for foreign debts due to the foreign central banks’ willingness to hold dollar assets. If the USD depreciates, it risks losing its reliability as a world reserve currency. The Euro is the closest to the USD as a principal reserve currency, which holds about 20.4% of the global forex reserves as opposed to the USD’s 58.36%. However, the size and stability of the dollar asset markets, along with the sovereign debt crisis in the European states and the power of ‘incumbency’ of the USD, may not contribute enough to help the euro overtake the USD as the principal reserve currency (Elwell, 2012). Therefore, a fall in the value of U.S. bonds and the USD possibly losing its status as the world’s reserve currency is terrible news for India, which holds foreign exchange reserves of $599.53 billion for the week which ended on May 19 (Reserve Bank of India, 2023).

Long-term impact on global financial systems A U.S. default could trigger widespread uncertainty in global financial systems, as U.S. bonds and the dollar are widely regarded as safe-haven assets. For decades, the USD has been the backbone of international trade, and U.S. Treasury bonds have been the cornerstone of central banks’ reserves. If these assets lose their stability, countries—including India—may need to reconsider how they structure their foreign exchange reserves and trade agreements. The depreciation of the dollar could also create opportunities for alternative currencies, such as the Euro, Chinese Yuan, or even digital currencies, to gain prominence in international finance. However, these transitions would take time, and in the interim, global markets could experience volatility. For India, this could mean significant disruptions in trade, investment flows, and monetary policy. A multi-currency system could emerge in the long term, reducing dependency on the USD, but this would require significant shifts in global economic infrastructure. |

Way Forward for India

As the current international system revolves around the USD, switching to an alternate system is unfeasible for India in the short run because there are not enough viable alternatives in the international financial and economic system. However, India could work towards creating a ‘multi-currency’ international financial system that would not be too dependent on the USD’s movements.

Some positive steps have already been taken in this direction. The RBI set up the rupee trade settlement mechanism in July 2022 to attract other countries. Russia was the first to start foreign trade owing to the sanctions placed on it due to the Russia-Ukraine war. Countries like Sri Lanka, Bangladesh, and Myanmar have commenced trade, and Cuba, Luxembourg, Tajikistan, and Sudan have started Special Vostro Rupee Accounts (SVRAs). Meanwhile, the RBI has approved the Vostro accounts of Sri Lanka and Mauritius (Sharma, 2023)

Furthermore, the RBI has permitted banks from 18 countries including the United Kingdom, Israel, Germany, Russia and Singapore- to settle payments in INR through SVRAs, moving away from USD dependence. India aims to use the SVRAs to trade directly in INR rather than hard currencies like USD or Euro. Generally, countries pay in a foreign currency – mostly the USD- for importing and exporting goods and services. This means a buyer in India would have to first convert the rupee into USD to pay the foreign seller, who would then convert the USD into his currency. Both parties pay conversion costs and incur risks of fluctuating foreign exchange rates (Sharma, 2023). Using an SVRA will help overcome these obstacles.

A Vostro account allows countries to obtain an invoice for goods and services made in Indian rupees, provided the second party has a Rupee Vostro Account. When an Indian buys from a foreigner in rupees, the Vostro account will be credited with the amount. The account will be debited when the Indian exporter needs to be paid for goods exported, and the money is credited to the exporter’s account. To open an SVRA, a foreign bank may contact an Authorised Dealer (AD) bank in India, which will then request RBI approval. Once the approval is granted, the SVRA in the Indian AD bank by the foreign bank will be operational. The trade between the two parties can then be settled in INR, and the exchange rate between the currencies can be established by the market (Sharma, 2023).

Although this is an encouraging development, there have been very few transactions in the Vostro accounts. India is still buying Russian oil in dollars. Moreover, India does not allow full capital account convertibility, fearing a short-term mass exodus of capital and massive exchange rate volatility. In contrast to the USD’s 88%, the euro’s 31%, the yen’s 17%, and the pound sterling’s 13% daily average shares in the entire turnover of the foreign currency market, the rupee’s stake is just 1.6%. Therefore, India still has a long way to go.

Opportunities for India amid the U.S. debt ceiling crisis

While the U.S. debt ceiling crisis presents significant risks, it also offers strategic opportunities for India. With the global financial system in flux, India could position itself as a more prominent player in the international economy. By promoting the use of the Indian rupee in international trade and expanding its network of trade agreements, India could reduce its reliance on the dollar and strengthen its economic sovereignty.

Furthermore, sectors such as technology and manufacturing could benefit from shifting global supply chains as companies and countries diversify away from the U.S. market. India could also attract foreign investments, particularly in its growing digital and fintech sectors, as global investors seek alternatives to the volatility of the U.S. economy.

Register your interest in studying at ISPP

Conclusion

The centrality of U.S. financial instruments in the international financial system cannot be denied. However, countries, including India, cannot place their entire economic and financial stability on the domestic political developments in the U.S. The tensions surrounding the U.S. debt ceiling crisis are a testimony to this. Therefore, India should slowly move from the US-driven international financial system towards participating in or initiating a multi-currency international financial system.

References

Aratani, L. (2023a, April 30). Danger and deja vu: What 2011 can tell us about the US debt ceiling crisis. The Guardian. https://www.theguardian.com/business/2023/apr/30/us-debt-ceiling-congress-republicans-democrats-2011

Aratani, L. (2023b, May 16). What is the US debt ceiling and what will happen if it is not raised? The Guardian. https://www.theguardian.com/business/2023/may/16/what-is-debt-ceiling-limit-explainer

Berman, N. (2023, May 2). What Happens When the U.S. Hits Its Debt Ceiling? Council on Foreign Relations. https://www.cfr.org/backgrounder/what-happens-when-us-hits-its-debt-ceiling

Edelberg, W., & Sheiner, L. (2023, April 24). How worried should we be if the debt ceiling isn’t lifted? Brookings. https://www.brookings.edu/2023/04/24/how-worried-should-we-be-if-the-debt-ceiling-isnt-lifted/

Elwell, C. K. (2012). The Depreciating Dollar: Economic Effects and Policy Response. Washington D.C. Retrieved May 17, 2023, from https://sgp.fas.org/crs/misc/RL34582.pdf.

ET Now Digital. (2023, March 16). India shining: Rupee inches closer to becoming international currency; these 18 countries now accept trade payment in INR – Full list. TimesNow. https://www.timesnownews.com/business-economy/india-shining-rupee-inches-closer-to-becoming-international-currency-these-18-countries-now-accept-trade-payment-in-inr-full-list-article-98683541

Fan, E. X. (2002). Implications of a US Dollar Depreciation for Asian Developing Countries (pp. 1–14). Manila: Asian Development Bank. Retrieved May 15, 2023, from https://www.adb.org/sites/default/files/publication/28069/pb011.pdf.

Lovely, M. E., & Russ, K. (2023, March 9). Opinion: Republicans are playing with fire. CNN. https://www.cnn.com/2023/03/09/opinions/debt-limit-national-security-lovely-russ/index.html

Manohar, A. (2023, May 16). Nifty close to record high amid US debt ceiling talks. Will it climb to a new peak?. Mint. https://www.livemint.com/market/stock-market-news/nifty-close-to-record-high-amid-us-debt-ceiling-news-will-it-climb-to-a-new-peak-11684219352186.html

Reserve Bank of India. (2023, May 19). Foreign Exchange Reserves. https://m.rbi.org.in/scripts/WSSView.aspx?Id=26104

Sharma, U. (2023, January 3). Indian rupee going global: After Russia, 35 countries show interest in foreign trade settlements in INR. Firstpost. https://www.firstpost.com/business/indian-rupee-going-global-after-russia-35-countries-show-interest-in-inr-trade-settlement-mechanism-11921652.html

Snell, K. (2023, May 15). What you need to know about the debt ceiling as the deadline looms. NPR. https://www.npr.org/2023/05/15/1175733139/debt-ceiling

Stein, J. (2023, May 14). If U.S. debt ceiling isn’t raised by deadline, what does default mean? – The Washington Post. https://www.washingtonpost.com/business/2023/05/14/debt-ceiling-deadline-what-default-means/

The New Indian Express. (2023, March 20). Rupee far from being a global currency. The New Indian Express. https://www.newindianexpress.com/opinions/editorials/2023/mar/20/rupee-far-from-being-a-global-currency-2557586.html

The White House. (2023, May 3). The Potential Economic Impacts of Various Debt Ceiling Scenarios. The White House. https://www.whitehouse.gov/cea/written-materials/2023/05/03/debt-ceiling-scenarios/

Yellen, J. (2023). U.S. Department of the Treasury. Washington D. C. Retrieved May 23, 2023, from https://home.treasury.gov/system/files/136/Debt-Limit-Letter-to-Congress-Members-20230522-McCarthy.pdf.

B R Neeraj

B R Neeraj is a fifth-year undergraduate in the Department of Humanities and Social Sciences, IIT Madras, pursuing an Integrated M.A. in Development Studies. His academic interest lies in International Relations, particularly India’s foreign policy, its influences and consequences. He is also interested in history, primarily Indian and Military History, and International Economics, focussing on India’s external trade.

FAQS

What is the U.S. debt ceiling crisis?

The U.S. debt ceiling crisis occurs when the government reaches the maximum limit set by Congress on how much it can borrow. Without raising the ceiling, the U.S. risks defaulting on its debt obligations.

How could a U.S. default impact India?

A U.S. default could cause volatility in Indian financial markets, affect foreign trade due to a weakening dollar, and reduce the value of India’s foreign exchange reserves, which include U.S. Treasury bonds.

What steps has India taken to reduce its dependence on the U.S. dollar?

India has set up the rupee trade settlement mechanism and Special Vostro Rupee Accounts (SVRAs) to encourage international trade in Indian rupees, reducing dependency on the dollar.

How would a weakening dollar affect India’s trade balance?

A weaker dollar could make imports cheaper, improving India’s trade balance. However, it could harm export sectors like IT and pharmaceuticals, which rely on a competitive exchange rate.

What opportunities does the U.S. debt crisis present for India?

The crisis offers India a chance to promote the rupee in international trade, attract foreign investment, and strengthen its position in global supply chains and emerging sectors like technology.